Nick Shaw

Nick Shaw has been Chief Revenue Officer (CRO) of Brightpearl, the number one retail-focused digital operations platform which encompasses sales and inventory management software, accounting, logistics, CRM, and more.

As cash and cheque payments have gradually declined in popularity as means of processing business transactions, the advantages of online payment systems have become increasingly clear.

Whether you’re an eCommerce retailer that does 100% of its business online, a bricks-and-mortar business looking to branch out or provide alternative payment methods for your customers, or you offer a hybrid customer experience with both physical and digital outlets, understanding the ins and outs of online payments systems, and how they benefit businesses of all kinds is certainly worthwhile.

In this article, we’ll briefly look at what we really mean when we use the phrase online payment system before looking at the five top advantages of incorporating one into your business model.

What is an online payment system?

Before we discuss why they are so advantageous to businesses, what exactly is an online payment system?

The phrase online payment system actually refers to the coupling of two separate technology components needed to process payments over the internet: a payment gateway and a payment processor. Because many popular online payment solutions such as Paypal function as both gateway and payment processor, the term payment system is used to refer to the combination of the two.

Online payment systems vary in their features, the currencies, protocols, and jurisdictions they are compatible with, and the payment options they facilitate. For example, not all systems can handle both credit and debit card transactions or are integrated with all the different payment networks—Visa, American Express, etc.

So now you know what an online payment system is, what exactly are the advantages of incorporating one into your business?

1. Increased online sales

Perhaps the greatest advantage of an online payment system is its potential for driving up online sales.

Alongside things like a stellar SEO strategy built around keyword research, topic clusters, and targeted content, offering the right blend of payment options is going to help you convert visitors to your website into paying customers.

When choosing the best online payment system for your sales strategy, keep in mind that in general, the more payment methods you offer, the more likely people are to make a purchase.

Thankfully, there are plenty of options for payment gateways and payment systems that will help you offer your customers a choice of how to pay.

What’s more, modern content management systems integrate with a growing number of these systems. For example, as well as its own native payment gateway, Shopify integrates with over 100 other payment providers from around the world.

This means that no matter which markets you cater for, it’s likely there’s a payment solution that will fit seamlessly into the Shopify eCommerce platform and allow you to process payments through your Shopify website.

2. Streamlined order fulfillment

Order fulfillment processes are typically built around merchant fulfillment, third-party fulfillment, drop shipping, or a combination of order fulfillment models. Having the right payment system in place is one of the most important things you can do to streamline the process and deliver the best possible service to your customers.

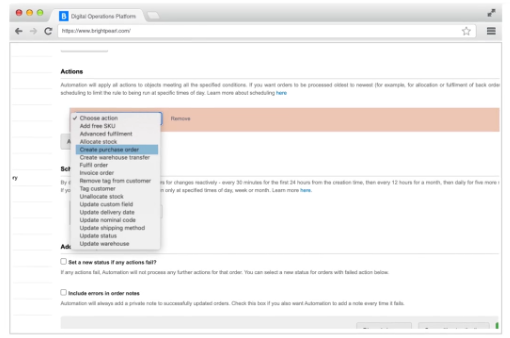

When it comes to streamlining order fulfillment, automation is your friend. Not only does it reduce the time between purchase and delivery, but it can also limit human error, resulting in fewer overall returns and reships.

Some payment systems can even be synchronized directly with your inventory management system such as these Skuvault alternatives.

By syncing up your payment system and your Ecommerce inventory management software, you can improve the efficiency of inventory control processes by connecting your online sales channels directly with your warehouse or other inventory storage locations.

The ultimate prize of connecting payment and inventory management systems is greater automation. Between a customer adding an item to their online shopping cart to that item arriving at their address there are a whole host of intermediate steps.

Warehouse logistics such as picking, packing and delivery all offer opportunities to automate workflows, saving your employees time and effort every step of the way.

3. More secure transactions

For years, companies that handle cash have had to protect themselves against criminals looking to steal that cash. To make matters worse, dishonest employees, counterfeit bills, and honest mistakes can all introduce losses to your accounts and hurt your bottom line.

While online payments aren’t entirely resistant to theft or fraud, there are still significant security advantages of online payment systems and the global banking system has developed a number of protocols to ensure maximum security of transactions.

An ACID transactions database refers to a database that enforces the principles of Atomicity, Consistency, Isolation, and Durability.

ACID properties guarantee that when money is transferred from one account to another, the transaction is permanent and verifiable, or in case of failure, both accounts have the same initial state. Because ACID transactions are implemented as standard in modern payment systems, every transaction is guaranteed, even in the event of errors, power failure, etc.

Although protocols that ensure ACID properties are guaranteed for the databases used in financial transactions, you should still follow cybersecurity best practices to prevent losses from online banking fraud and protect your customers.

4. Environmentally Friendly

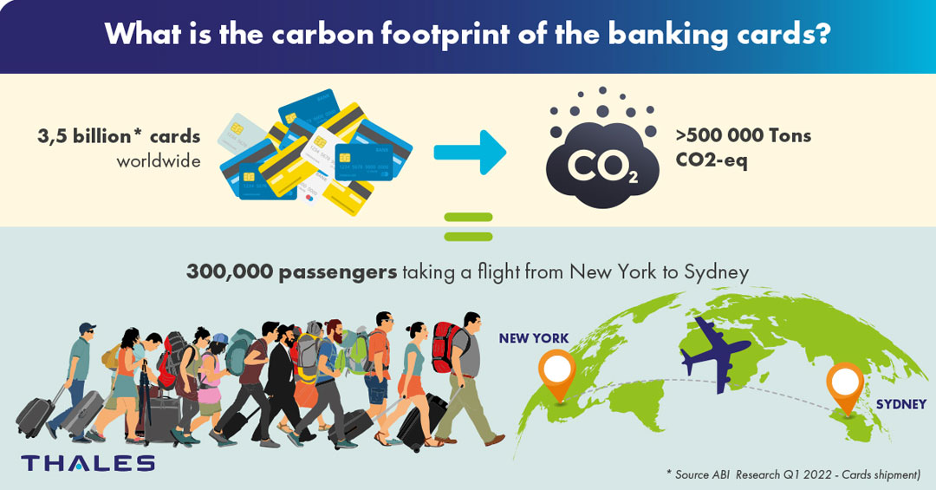

Between the raw materials, transport, and heavy infrastructure needed to sustain it, it should come as no surprise that cash is one of the most inefficient, carbon-intensive payment systems in use today. But with consumers increasingly demanding more sustainable payment technologies, the environmental impact of credit and debit cards has now also come under scrutiny.

Research by Thales Group found that the average carbon footprint of a bank card is equivalent to around 150 grams of carbon dioxide. Of this, 60 grams comes from the materials used, 50 grams is emitted by the manufacturing process, and 40 grams comes from other sources including transport and packaging.

What’s more, in 2018, Dutch researchers discovered that the largest contributors to the environmental cost of debit card payments were not the cards themselves, but payment terminal materials and terminal energy use. They calculated that these make up 27% and 37% respectively of the absolute environmental impact of each payment.

Because they eliminate the need for plastic cards and card readers, purely digital transactions are some of the most environmentally friendly types of transactions. They require no new materials or equipment that people don’t have anyway, and use only minimal electricity compared to other transaction types. Ultimately, a lower average carbon footprint per transaction is one of the main advantages of online payment systems.

There are of course a few other things you can do to really lower the emissions your business generates from payment processing. For starters, why not implement paperless billing and send all your receipts and invoices as digital files? Not only does this save on unnecessary paper and fuel expenditure, but your customers and business partners might actually prefer it.

5. Efficient Enterprise Resource Planning

Enterprise resource planning (ERP) is the integrated management of key business processes. An ERP system is a type of software that organizations use to manage day-to-day business activities such as accounting, procurement, project management, risk management, and supply chain operations.

A typical ERP system such as one of the many Netsuite competitors consists of a suite of integrated applications that an enterprise uses to collect, store, manage, and interpret data across its various business activities.

When set up correctly, all of a company’s online transaction data is collected and recorded by your online payment system. Because so many businesses these days use point of sale (POS) software to process cash, credit, and debit card payments, between your online payment system and your POS software, you have a record of pretty much every incoming payment you receive.

Even better, a growing number of payment solutions are combining the functions of payment systems and POS software into a single general purpose payment platform. That means all payment data goes through the same system.

Integration of this data flow into a centralized ERP system, businesses can support all aspects of financial management, human resources, supply chain management, and manufacturing. That means you can make the best data-driven decisions, safe in the knowledge that there are no discrepancies between different systems and databases

By aligning payment data with other data flows, there’s no need to allow for error margins when ordering stock and managing distribution. It also makes it easier to discover when and where resources get lost or diverted.

Online payment systems in the post-cash society

As the world transitions towards a cashless economy, online payment systems have a central role to play in the way modern businesses operate. Even organizations that do most of their business face to face may soon find themselves more dependent on online sales.

Just look at what happened during the lockdowns of 2020/2021 when many businesses were forced to temporarily close their physical premises. Those companies that were able to seamlessly transition to a digital-first sales strategy were the ones best able to mitigate their losses. For many of these businesses, the changes became permanent and their online payment systems have become indispensable.

From increasing sales and security, to optimizing order fulfillment and ERP, to helping you cut your organization’s carbon emissions, there are loads of benefits of getting your business set up with an online payment system. With all these advantages, what are you waiting for?

About the author

Nick Shaw

Nick Shaw has been Chief Revenue Officer (CRO) of Brightpearl, the number one retail-focused digital operations platform which encompasses sales and inventory management software, accounting, logistics, CRM, and more, since July 2019 and is responsible for EMEA Sales, Global Marketing and Alliances. Before joining Brightpearl, Nick was GM and Vice President of the EMEA Consumer business at Symantec and was responsible for a $500m revenue business. Nick has written for sites such as Hubspot and G2. Here is Nick Shaw’s LinkedIn.

Related articles